Verity journal

Verity Journal

Responding to the increase in money laundering activities and the worrying threat of terrorism financing, the Malaysian government and Bank Negara established the Anti-Money Laundering and Counter-Terrorism Financing measures to ensure that businesses can be held accountable by providing legal and regulatory framework.

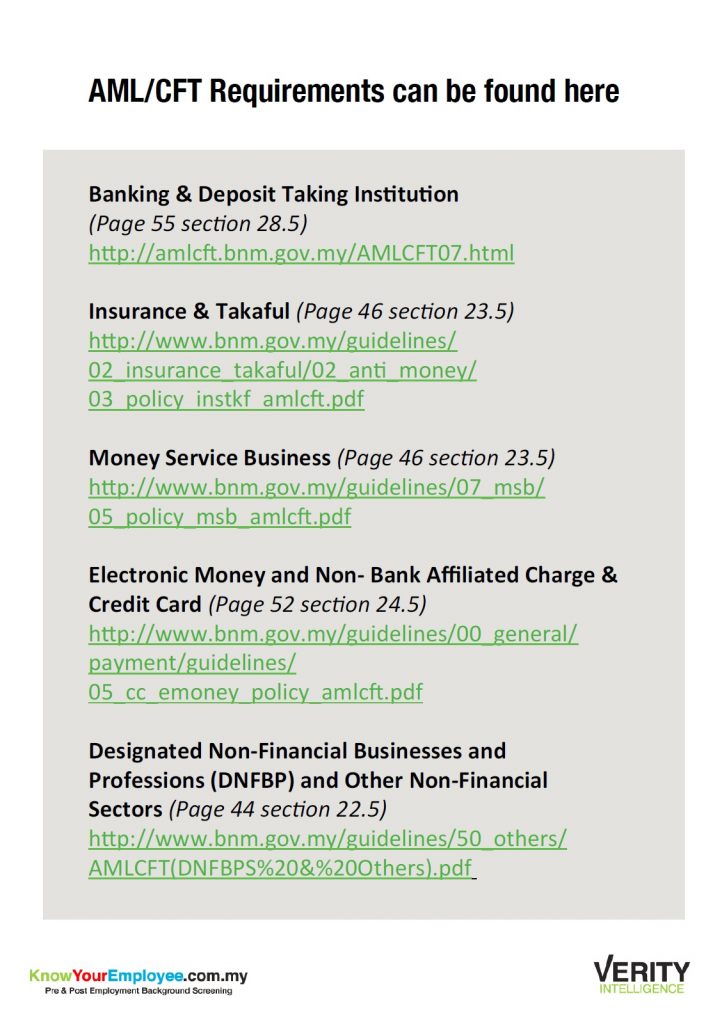

The framework includes preventive measures for reporting institutions, financial intelligence units and law enforcement agencies, alongside domestic and international cooperation.

With the framework and laws in place, financial institutions (banks, insurance companies, pension funds) need to do their part by ensuring that their staff, including agents (eg. insurance agents) are held at a high standard of accountability too. Background screening, for pre- and during-employment, is a way to address this.

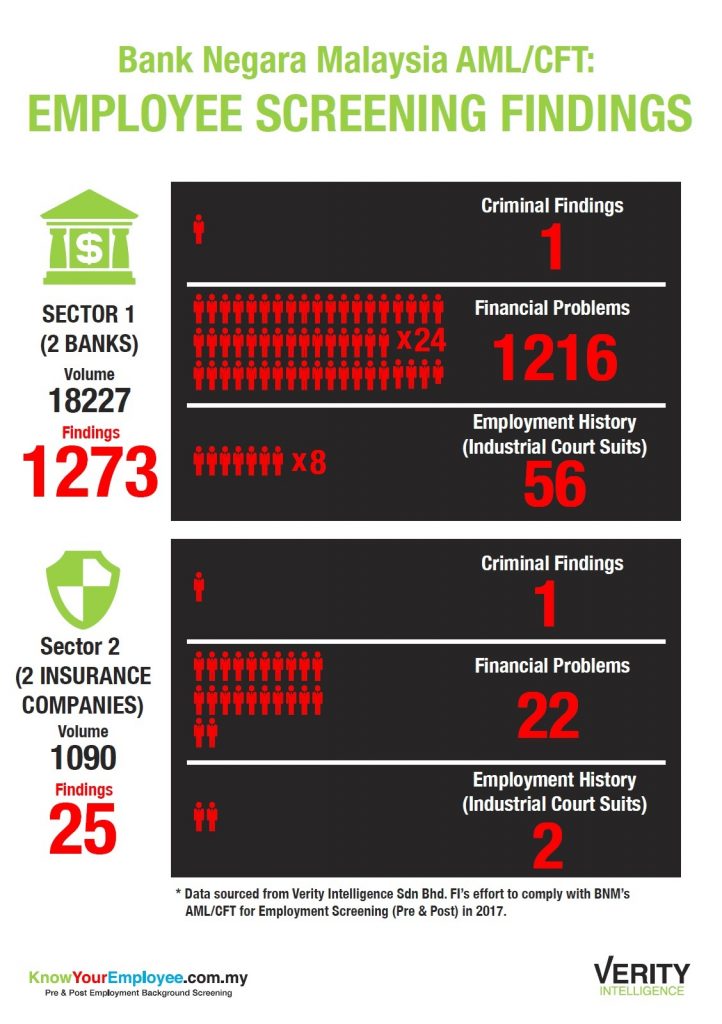

For 2017, Verity Intelligence did a study to comply with Bank Negara’s AML/CFT framework for employment background screening and this is what they found.

With thousands of personnel in each financial institution, be it a bank or an insurance company, it is really hard to claim you know all your employees very well. Based on the study conducted, it is common to find employees suffering from financial difficulties – which could drive them to take desperate measures, such as being dishonest in business transactions and embezzlement.

Pre-employment and during-employment background screenings can be a helpful way to identify employees with these sorts of problems; a company can then decide if they need to intervene by providing help. Knowing your employees will allow one to help them when they are in need. In return, business risks are reduced, hence maintaining the standards provided by the AML/CFT framework.

Do you believe your financial institution is meeting this standard? Perhaps this is a concern you should be addressing! Check out www.verityintel.com to learn more.

You must be logged in to post a comment.

There are no comments